End IRS Stress. Stop Liens, Levies, and Garnishments. Resolve Back Taxes—for Good.

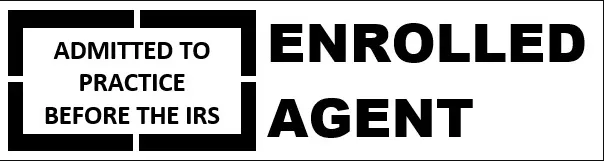

Are tax issues keeping you up at night? Let IRS RESO handle them for you! With Lenard de Guzman, EA’s deep understanding of IRS procedures and tax resolution, we have the knowledge and experience to resolve even the toughest tax challenges.

IRS RESO Can Help With ANY Tax Problem!

About Us

Is Tax Relief Really Possible?

Like many of our clients, you’re likely a responsible person who made an honest mistake. What matters most is that you’re taking the first step toward resolving the issue and regaining control of your tax situation.

The problem: Dealing with the IRS can feel like entering a maze with no clear way out. Even many tax professionals shy away from IRS representation due to its complexity!

Whether you’re proactively addressing a tax issue or already facing enforcement actions like a bank levy, the most important step is securing a knowledgeable professional to advocate for you.

The IRS offers various programs to help taxpayers regain compliance. Lenard de Guzman, EA, has extensive experience navigating these programs and will work to find the best solution to resolve your tax issues and restore your good standing with the IRS.

Our IRS Tax Relief Process

Innovative Solutions for

Modern Tax Problems

You don’t hire us just to fill out forms—you could do that yourself. You hire us because we understand the complexities of each program and know how to present your case strategically, using IRS rules to your advantage. Our goal is to secure the best possible resolution and help you put your tax troubles behind you for good.

Evaluation

Schedule a FREE one-hour case evaluation with Lenard de Guzman, EA, to assess your tax situation and explore the best resolution options.

Investigation

As your authorized representative, you won’t have to deal with the IRS directly anymore. We’ll handle all communication and begin working on the best resolution for your specific case.

Resolution

We’ll bring you into IRS compliance by filing any outstanding tax returns and securing the best settlement program for your situation.

Tax Relief & IRS Representation

If you’re dealing with a tax issue – We’re here to help!

Assessment & Analysis

Planning & Implementation

Monitoring & Adjustment

02

Assessment & Analysis

Unlike many other Los Angeles based tax firms, IRS RESO specializes exclusively in Tax Relief.

When you hire IRS RESO, you’re working with a true tax relief specialist—not a general accountant who occasionally takes on IRS cases. We focus solely on tax resolution and stay up to date on the latest strategies to achieve the best results for you.

01

Planning & Implementation

As our client, you won’t have to deal with the IRS directly anymore—we handle all communication on your behalf. If the IRS needs information or wants to speak with you, they’ll have to go through us. During the investigation phase, we gather essential details, pull transcripts, and determine exactly what the IRS knows about your situation.

After gathering all the necessary information, we’ll schedule a follow-up meeting to discuss your resolution options. Keep in mind that not everyone qualifies for every program, and it nay not be possible to determine your eligibility during the initial consultation.

03

Monitoring & Adjustment

Case resolved—your IRS troubles are over. We’ll also help you create a strategy to stay compliant and maintain peace of mind moving forward.

Our Process

Commonly Asked Queries

About Services.

Tax Debt Relief?

We specialize in IRS tax debt relief solutions, including Offer in Compromise, Installment Agreements, Innocent Spouse Relief, Penalty Abatement, and more. Our team will work closely with you to find the best strategy to resolve your tax issues permanently.

IRS Penalty Abatement?

Facing IRS penalties can be stressful, but you don’t have to deal with them alone. Lenard de Guzman is here to guide you through the penalty abatement process. We understand the qualifications for relief, whether it’s proving reasonable cause or addressing IRS errors, and we’ll work to help you reduce or eliminate unnecessary penalties.

Liens, Levies, and Garnishments?

If the IRS has initiated collection actions against you, now is the time to seek professional representation. Their enforcement tactics—such as tax liens, bank levies, and wage garnishments—can be overwhelming and disruptive. The good news? Once you hire IRS RESO, we take over all communication, so the IRS has to go through us to get to you.

Payroll Tax Issues?

Operating a business is demanding enough without the added stress of IRS issues. At IRS RESO, we help businesses of all sizes navigate complex tax challenges. Our team will assess your situation and create a customized plan to resolve your tax problems efficiently and effectively.

Newsletter

Tax Advocate Newsletter

Available exclusively to IRS DADDY Subscribers

Tax Resolution Program Spotlight: Bankruptcy & Tax Debt

Learn More

Why Is the IRS Using AI?

Learn More

Let's Talk: Schedule

Consultation Today!

Ready? Let's get started!

Complete the form below, and we’ll reach out to schedule your free case evaluation! During this session, we’ll review your situation and develop a customized plan to resolve your tax issues.

Copyright 2025. IRS RESO. All rights reserved.